Quick Summary

SPY hitting extreme overbought levels. Short trade has worked 7 out of the last 10 times at these levels. I will wait to short on an upmove or breakdown. Looking for pullback entry in IWM. Took partial profits in CODE today, still holding UA and GDP. Focus list additions WYNN and FB. CODE, GDP, UA removed from focus list as too far from entries now. Looking for pullbacks in some of the market leaders. EWZ has pulled back to the 50 dma.

The Market

Key Pivot Levels: 191.52: new high resistance 187.08: 50 day moving average 181.31: recent low 181-184: plenty of buying in this range.

Under the Hood:

SPY did little today, but it is still holding on above the new high support level. As I noted the past two nights, even with the bearish indications, it is tough to short here given the improvement in small caps (IWM) and price action.

Trading Game Plan:

Absolutely nothing has changed from yesterday’s comments on SPY and IWM. I will wait to short after either a failed breakout or a move higher from here, and look to enter IWM on pullback.

Now let’s look at what has happened to SPY over the past year when stochastics reach *extreme* overbought levels. For overbought, I am not talked about the 70 overbought readings traders generally watch for. We are looking at readings over 90. This level is more important when dealing with a trending market.

Over the past year, we have had 10 instances where readings hit 90. If we entered short at the moment the red and black lines begin to touch, as is happening now, a short trade would have been successful 7 out of 10 of those trades for a 70 percent win rate. The odds favor shorting.

Take focus list setups as they come. No directional bias.

The Focus List

Here we find actionable setups culled from “the watchlist” for the coming trading day.

GDP held on to yesterday’s gains. I am still holding the remaining half position after taking profits. It is not near entry level and is off the focus list for now.

UA is nearing my target level. It is not near entry and off the focus list for now and moved back to the watchlist.

CODE hit my target. I have moved stop to entry. It is no longer near entry and is off the focus list and moved back to the watchlist.

WLB didn’t do much. We still wait for a pullback. Target is recent high at $32, stop is around $28.50. Entry at $29 offers 6:1 reward to risk ratio.

A few of you entered BEAV today. I chose not to because of the market conditions. Though it pierced the small basing area, it should still be above stops. Remember with this trade the reason it was attractive was that the 4:1-5:1 risk ratio made up for the higher possibility of hitting stops (gap fill and market)

New addition:

WYNN is showing a great volume pattern and broke out over the 50 dma. My stop would be placed under yesterday’s breakout bar ($206) with an initial target around $230. Entry is in the $211-214 range.

FB: The chart is almost identical to WYNN, though the volume pattern is not quite as good. Note that these charts are also similar to NFLX and GOOGL pre-breakout.

The Watchlist

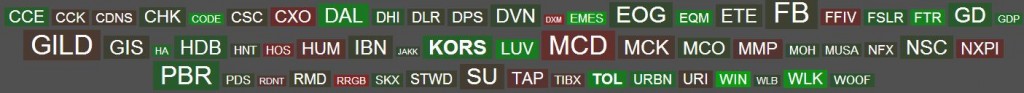

There were a few breakouts today (DAL, WIN, TOL), and FB and WYNN were put in the focus list. Other than that most moved within trading ranges.

Click here and scroll over ticker to see thumbnail chart

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market (TSLA in recent months).

Most of these guys stalled today with small gains or losses after nice moves in previous days. If the market pulls back we should find some nice entries here. We’ll continue to monitor CAT and TSLA as short setups. CAT had just missed short entry yesterday and is now too far away.

Sector and International ETFs

EWZ (Brazil) has been on fire and has now pulled back close to the 50 dma. Stochastic is oversold. An entry under $47.50, with stop at $46.30 and target at $50 gives 2:5:1 risk.

Current Trades

Took partial profits in CODE as target was hit. Stop moves up to entry level and the trade is now in “let it ride” mode. Still holding partial position in GDP in “let it ride” mode. UA is nearing target.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh)