Quick Summary:

SPY not confirming new highs. QQQ analysis. Eight focus list stocks to start the week: JEC,BIDU,KORS,NLNK,UNTD,BCRX,GMCR,GWPH. Weak market leaders looking to reverse downtrends.

Video Analysis (4 minutes):

No video analysis today. I’ll have an intra-day analysis mid-day Monday.

Key SPY Pivot Levels: Old high 190, 50 dma 196, 190 gap fill and support level

Under the Hood and Trading Game Plan:

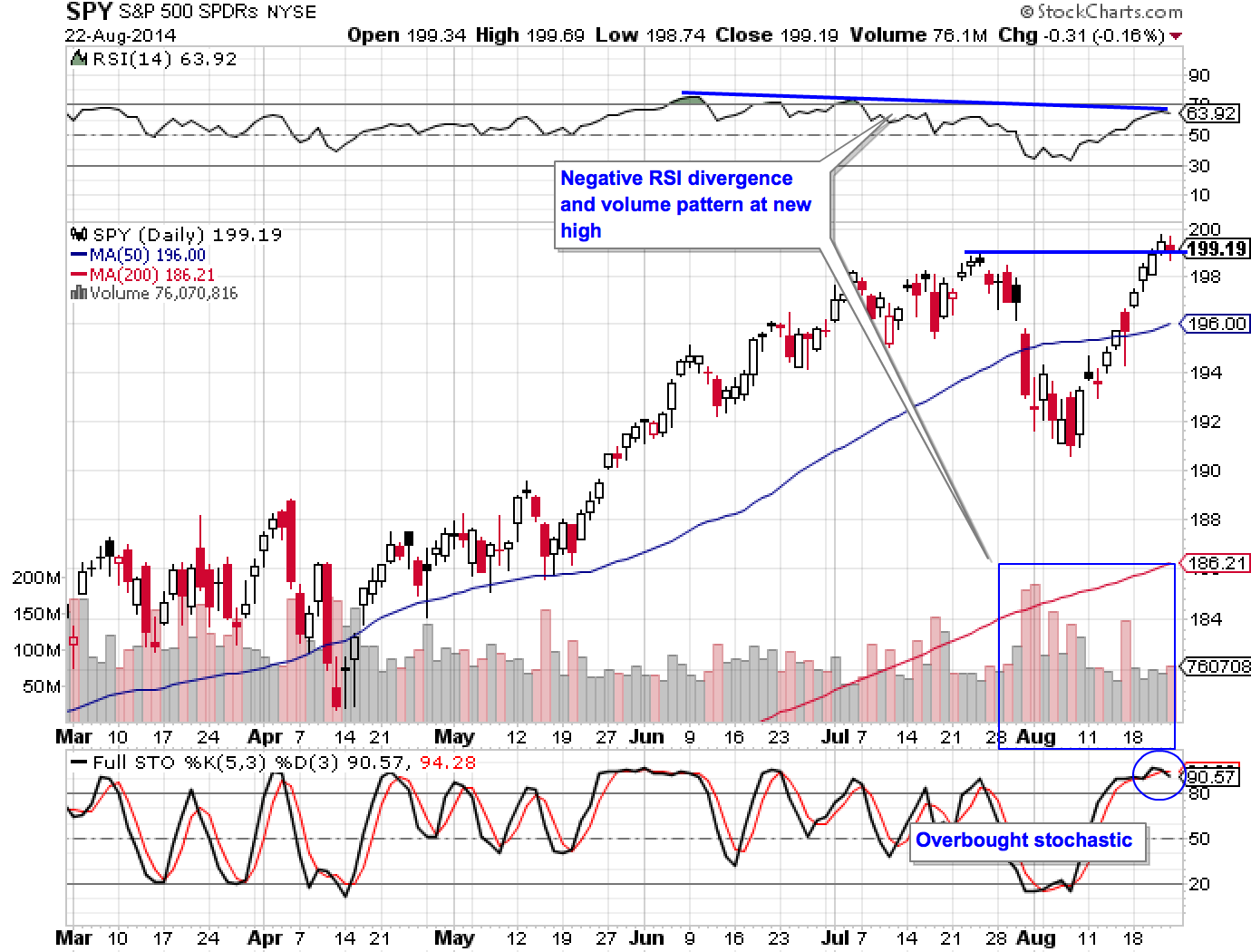

SPY did little on Friday, holding the new high breakout while still exhibiting bearish patterns. The negative divergence, poor volume and overbought stochastics are still there, and overall market breadth still does not confirm the breakout or point to an extended run. The Ruseell 1000 still is only showing 5-8 5% breakouts/day. That’s not the sign of a strong market.

The Nasdaq is showing an even stronger negative divergence. Notice that during the recent uptrend RSI continued to act strong and make new highs in line with price. This is what you want to see in strong markets.

The current game plan is to add to the SPY short position via SPXU if price moves up weakly to around $200. I continue to look for long setups on momo stocks, but will not chase.

Current Trades

I am still holding TWTR and a half feeler position SPY short via inverse ETF SPXU.

The Trade Journal

The Focus List

Finviz link to easily follow the focus list.

BCRX has pulled back from highs and now basing at 50 dma support. Entry here with stop around $12.25 and target $14-14.50. Notice that there was a negative RSI divergence at the recent high.

GMCR broke out on strong volume over 4 month range. Entry on pullback into the $125-129 range.

GWPH is basing at the 50 dma. This is not the strongest setup, as price is barely holding the ma. However, it offers great reward to risk if it does not break. An entry here at $90, with target at $105 and stop at $88 would give a whopping 7:1 reward to risk ratio.

JEC is on it’s way to bottoming from a down trend, remounting the 50 dma on strong volume. Entry on pullback $53.25.53.50 with target at $57 and stop at $52.

UNTD has formed a high and tight flag pattern post breakout, over the 200 dma. Entry at the bottom of the range around $12, with stop at $11.50 and tarot at $13.

BIDU has formed a post earnings breakout range. Entry near lows of the range, $210-213. Stop under the range and target near high of the range $225-230.

KORS is showing some signs that it might be bottoming or ate least in line for a gap fill move. Entry on pullback range of $80.25-81. Stop $79 and target $84.

NLNK is a biotech pulling back on low volume to moving average support, and bounced of Friday.. Entry $24.25-24.75. Stop at $22.90 and target near $30

Short Setups:

My focus now is shorting SPY via SPXU.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

GMCR was close to being dropped from the list, but broke out strong on Friday. It is now a breakout-pullback setup. CAT pulled back right up to gap fill and has stalled. It only becomes bullish if it can mount the gap fill area. AMZN is on the first phase of trying to regain it’s uptrend. Whichever way GOOGLE breaks from it’s consolidation should give us an idea of it’s trend. Earnings breakouts NFLX and FB are at the top of ranges.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh). dddd