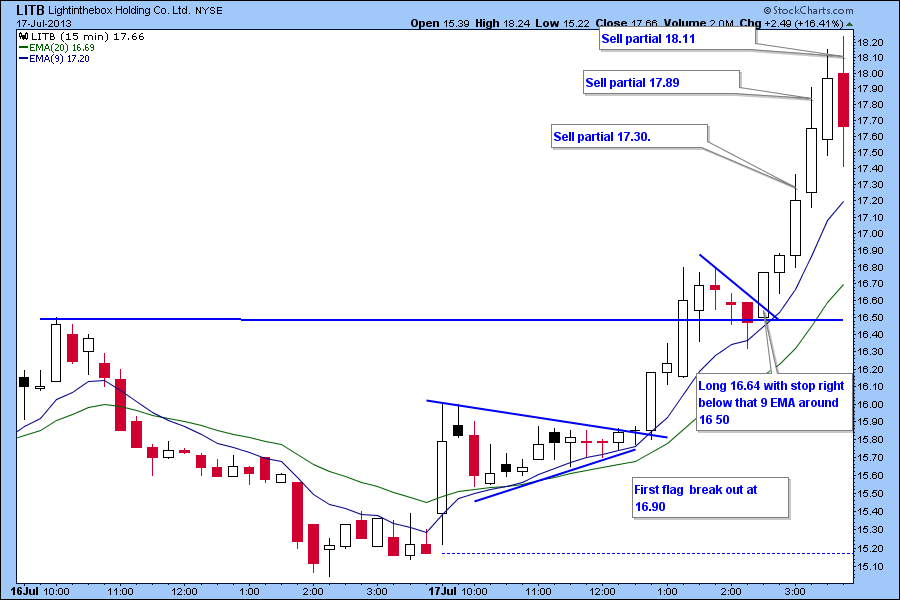

I traded this $LITB today in the chat room. This is one of those hot new Chinese IPO stock that I have traded many time before. I missed the first morning breakout and was eyeing the stock all day for a late day breakout entry. Momentum stocks need to consolidate during the afternoon hours. If it’s late in the day, I switch to a 15 minute chart with 9 and 20 EMA. Usually momentum names will bounce on either the 9 EMA or 20 EMA on the 5 minute chart. Let’s see how LITB setup during the day on a 15 minute chart.

I missed that first flag breakout at $16.90 after consolidating above both 9/20 EMA.

Flag setup can be seen on the 15 min chart. Look at that candle bounce on the 9 EMA and previous resistance at $16.50. This is a clue that there was buyer for this stock and we can buy that stock on a flag breakout in anticipation that this will test the recent high of $16.80 and more. Our risk will be also be low and if the trade doesn’t work, we will only lose a small amount.

Long $16.64 with stop right below that 9 EMA around $16.50 area. Big move on the stock as that stock makes a high of $18.18!

Our risk was 14 cents with gain of $1.54.

Hope this helps! We cover this type of setup in additional detail in our Bootcamp classes.