Rubber Band Oversold Bounce Setup

Close your eyes. Now I imagine the stock you are swing trading is the stone in a sling shot. You pull the rubber band back as far as you can and let go. What happens next?

Answer: Your stock explodes in the other direction.

Welcome to the rubber band setup. It’s a fun setup. It’s a profitable setup. It’s also a commonly mistraded setup.

In our first live $UCO trade video, I detailed the reasons for entry and common mistakes traders make trading this setup. To review the 4 easy steps to trade the setup profitably are:

- Extreme oversold levels

- Key entry signals

- Volume

- Exit strategy

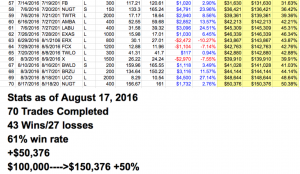

The trade is now complete. I made $4500 gain after taking 2 partial exits, putting the Trade Report account up over 50% in 2016 (see trading stats). In today’s video I review the entry and show you exactly why I took my exits where I did (which happened to be right where the stock reversed and pulled back.

This is a live trade alerted to Swing Trade Report members seconds after entry.

Our example is another in my series of live trade videos which makes it must watch: you’ll get into my head and see exactly how we plan and manage the trade as it develops. I’ll be back with another video on the exit.

This video is the third in the “Live” trading series.

Check out the first video to understand how $BRZU made our watchlist and the second video highlighting the gap down reversal trade in $NFLX. .

Remember, members of the swing service get all of these trade alerts intraday in real time.

This swing trading service is great for those that work and can’t monitor the computer all day. We have in-depth nightly reports on the game plan for the day/week, and all stock picks that I trade will be alerted and emailed to you.

Check out the Swing Service HERE

Follow me, Paul Singh AKA “TheMarketSpeculator” on Twitter or email me at SinghJD1@aol.com.