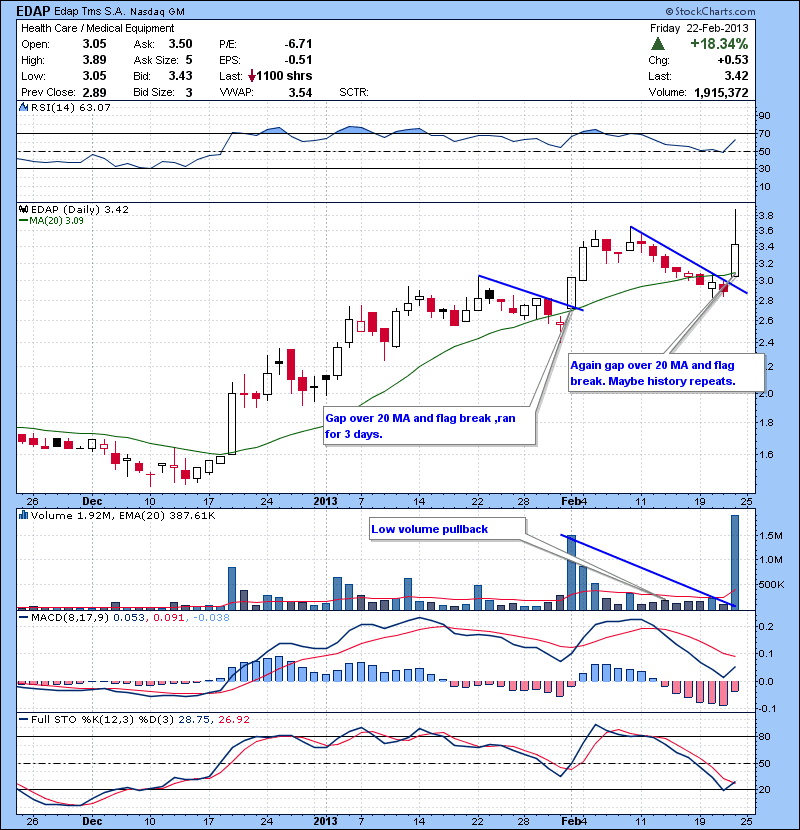

We traded $EDAP in the chat room Friday for big gains. The stock was my watch list as it was pulling back on low volume after a big volume run. As you can see on the daily chart, on 02/01 the stock gapped up over the 20 MA and broke out of the flag pattern. It ran for three days.

I was anticipating that type of move today when I saw the stock gapped up again over the 20 MA and broke out of another flag.

1.Stock gaps up . I always pay attention to stocks that had a small gap. A gap means someone is interested and they cannot wait to buy it, so they have a buy order ready at the open.

2.Stock flags as the moving average catch up

3. Buy at $3.14, with stop below moving average/$3.10 area

4.Sold partial $3.40

5. Added again at $3.41 on intraday break.

6.Sold all my shares at $3.82.

21.66% gain on my original shares, with $.04 risk and an additional 12% from the last add.

Share:

Facebook

Twitter

Pinterest

LinkedIn

Stock & Option Software

used by Bulls on Wallstreet

$EDAP: Trading Gap Up Flag break for over 22%

We traded $EDAP in the chat room Friday for big gains. The stock was my watch list as it was pulling back on low volume after a big volume run. As you can see on the daily chart, on 02/01 the stock gapped up over the 20 MA and broke out of the flag pattern. It ran for three days.

I was anticipating that type of move today when I saw the stock gapped up again over the 20 MA and broke out of another flag.

1.Stock gaps up . I always pay attention to stocks that had a small gap. A gap means someone is interested and they cannot wait to buy it, so they have a buy order ready at the open.

2.Stock flags as the moving average catch up

3. Buy at $3.14, with stop below moving average/$3.10 area

4.Sold partial $3.40

5. Added again at $3.41 on intraday break.

6.Sold all my shares at $3.82.

21.66% gain on my original shares, with $.04 risk and an additional 12% from the last add.

12% from the last add.

Share:

Stock & Option Software used by Bulls on Wallstreet

Social Media

Related Posts

Trading Watch List 04.19.2024

Market Speculator Part-Time | Swing Trade Report

Market Speculator Part-Time | Swing Trade Report

Day Trading Digest: Daily Stock Ideas 4/17/2024

Stop Guessing.

Start Trading.

Don’t Miss Out

Pre-Market Live-stream

Tuesday’s and Thursday’s at

9:00 AM EST.