Wow, what a week.

- Oil toys with $100 / barrel – a rocket ship up from mid 80’s just days ago

- gold hits highs it hasn’t seen in a while

- HP reports a very concerning outlook

- World in turmoil (Libya)

- Energy stocks, especially those not exposed to the middle east were strong

- Companies with high fuel usage got smacked (FDX, etc)

- Commodities prices starting to hurt some industries (report on CNBC today about how hotels getting hurt by linens prices thanks to cotton)

The underlying theme this week is clearly Fear! A good way to get a pulse of current sentiment is just to hit the major media sites and check out ‘most read’ section.

The underlying theme this week is clearly Fear! A good way to get a pulse of current sentiment is just to hit the major media sites and check out ‘most read’ section.

Tonight’s most read articles on major media sites.

Needless to say, the market drive is fear and not necessarily rational. Of course, there is cause for concern and I’m not suggesting to dismiss it. The market has clearly turned – emotionally and technically. Our priority, as traders, is to recognize when and where the market is being irrational and when the moves are up or down are valid. As long as the media pumps out messages of fear, the market will trade on fear and you’ll see strength in gold, silver, U.S. based oil companies. You’ll likely see weakness in anything heavily dependent on oil prices and tech companies. From a non-technical stand point, think about things that are necessary – food, tooth paste, etc. and scan for oversold opportunities that may bounce when the fear subsides.

The safe trade during fear is to not trade long term.. intraday scalps can be very profitable. If you’re going to swing. You gotta find stocks that have been in a nice strong bull run that have pulled back to significant support over the last two days. Tomorrow, watch these stocks.. did the support hold and the price bounce? That’s a possible swing.

One thing people aren’t talking a lot about – there is lots of economic data coming out tomorrow.. there is absolutely no telling where the market will take us (why I’m very heavy cash). If you’re heavily invested in a market that is nervous with lots of data coming out, you’re betting, not trading. Stay nimble.

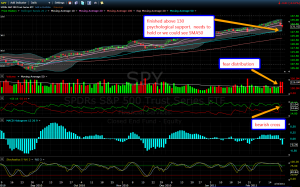

Technically, what can you say, we’ve broken down. HOWEVER, it was nice to see us bounce off the mid-day lows. The concern – we’ve lost major support levels and the volume was heavy today (distribution was strong).

Today’s Trades:

GSX 1/2 position long 4.00%

SPY March 130 puts long 7.63%

SPY March 130 puts long -1.96%

MOS March 80 calls long 16.39%

USO March39 puts long 10.19%

Also got out of AXL – bad trade. The stop was obvious (SMA50) and I waited too long to get out. Took a little hit here.

Still holding SPY, EMC, and PCX calls – upside down on all. Luckily, I play small positions in options to minimize risk.

I’m at 94% cash.

Current Positions and Market Thoughts

Wow, what a week.

Tonight’s most read articles on major media sites.

Needless to say, the market drive is fear and not necessarily rational. Of course, there is cause for concern and I’m not suggesting to dismiss it. The market has clearly turned – emotionally and technically. Our priority, as traders, is to recognize when and where the market is being irrational and when the moves are up or down are valid. As long as the media pumps out messages of fear, the market will trade on fear and you’ll see strength in gold, silver, U.S. based oil companies. You’ll likely see weakness in anything heavily dependent on oil prices and tech companies. From a non-technical stand point, think about things that are necessary – food, tooth paste, etc. and scan for oversold opportunities that may bounce when the fear subsides.

The safe trade during fear is to not trade long term.. intraday scalps can be very profitable. If you’re going to swing. You gotta find stocks that have been in a nice strong bull run that have pulled back to significant support over the last two days. Tomorrow, watch these stocks.. did the support hold and the price bounce? That’s a possible swing.

One thing people aren’t talking a lot about – there is lots of economic data coming out tomorrow.. there is absolutely no telling where the market will take us (why I’m very heavy cash). If you’re heavily invested in a market that is nervous with lots of data coming out, you’re betting, not trading. Stay nimble.

Technically, what can you say, we’ve broken down. HOWEVER, it was nice to see us bounce off the mid-day lows. The concern – we’ve lost major support levels and the volume was heavy today (distribution was strong).

Today’s Trades:

Share:

Stock & Option Software used by Bulls on Wallstreet

Social Media

Related Posts

Mastering Swing Trading: 27 Essential Rules for Success

Market Speculator Part-Time | Swing Trade Report

Trading Watch List 04.19.2024

Market Speculator Part-Time | Swing Trade Report

Stop Guessing.

Start Trading.

Don’t Miss Out

Pre-Market Live-stream

Tuesday’s and Thursday’s at

9:00 AM EST.