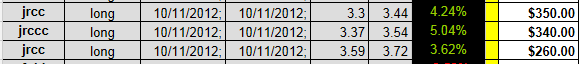

The coals have been on fire the past few days. Once you get a hot sector, that sector typically runs for a few days. Especially if its a beat down sector like the coals. We have seen the solars do this countless of times. They are all crappy stocks but when they catch fire they run. Thats why the type of trading we do is called short term momentum trading. We don’t care what the stock is or what the company is as long as it has volume and has momentum we will trade it until the momentum is gone. Today we traded $jrcc multiple times for nice gains each time, 4.2%, 5.04%, and 3.6%- total of $950!

If you want to learn to trade send me an email mb.willoughby@gmail.com I got suggestions.

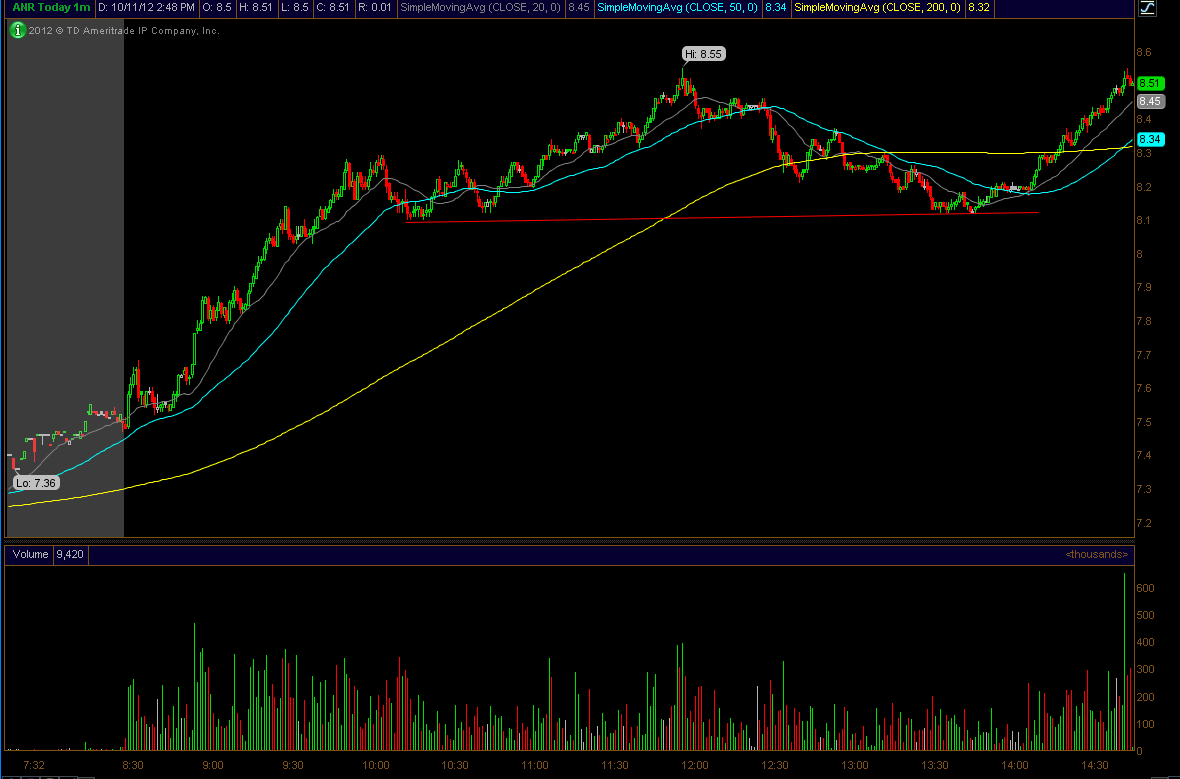

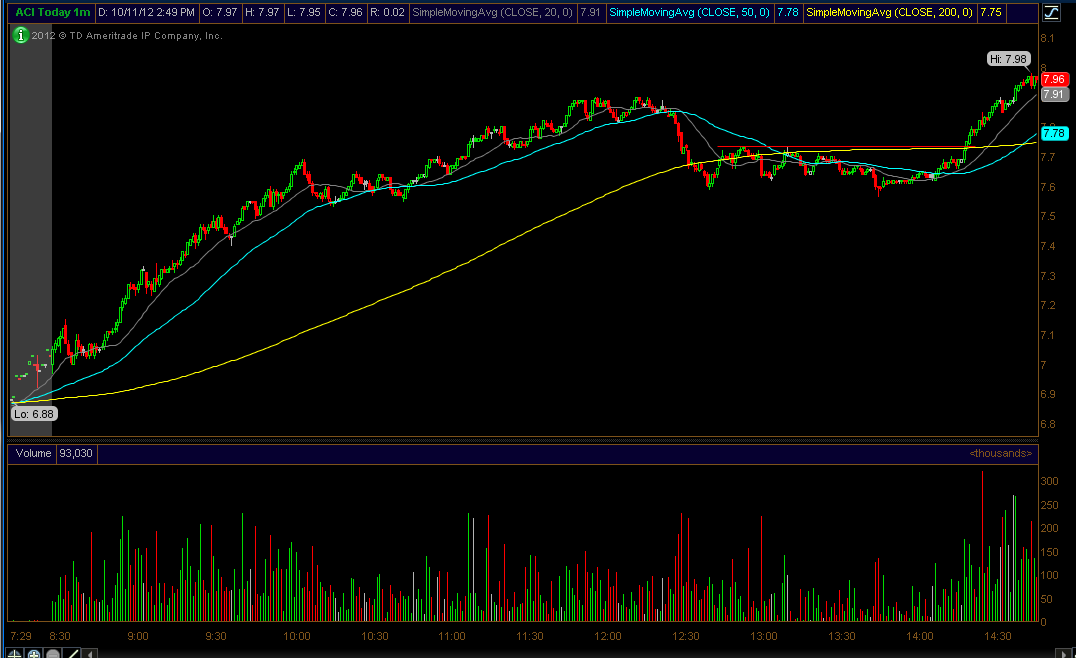

The last trade of the day in $jrcc is the one that I want to highlight. This was the classic afternoon intraday break and end of day run. The stock was strong all morning and then based out around lunch time, but never sold off. Thats the sign you are looking for and what we are scanning for in the lunch lull period to help us find potential afternoon trades. Well, right in the last hour of trading the thing that you should have noticed was the coal sector started showing strength again. Take a look at these charts.. all of them showed a setup that we know and love

1. WLT- late day flag break

2. ANR- intraday support held, late day range break

3. ACI- range breakout and run to hod

4. JRCC- intraday breakout and eod run