I hope you enjoyed our free chat day yesterday as much as I did! We had over 500 people in there, watching me trade, asking questions, and following along. I had a good day, making $2100 trading just 400 shares – the same restrictions as new students trading in my fund. But after a few trades, the one that really stands out is $SIG.

$SIG was halted over a harassment scandal. Let me say this up front: the content of the news, press release, or earnings doesn’t really matter. You can drive yourself mad trying to interpret the importance of any piece of news and how the market will respond to it and not be any closer to getting it right. Just know that news events add rocket fuel to a stock. We use technical analysis to pick our entries and exits, identify support and resistance, etc. – but the stocks we apply those tactics to usually have some sort of news-driven momentum behind them.

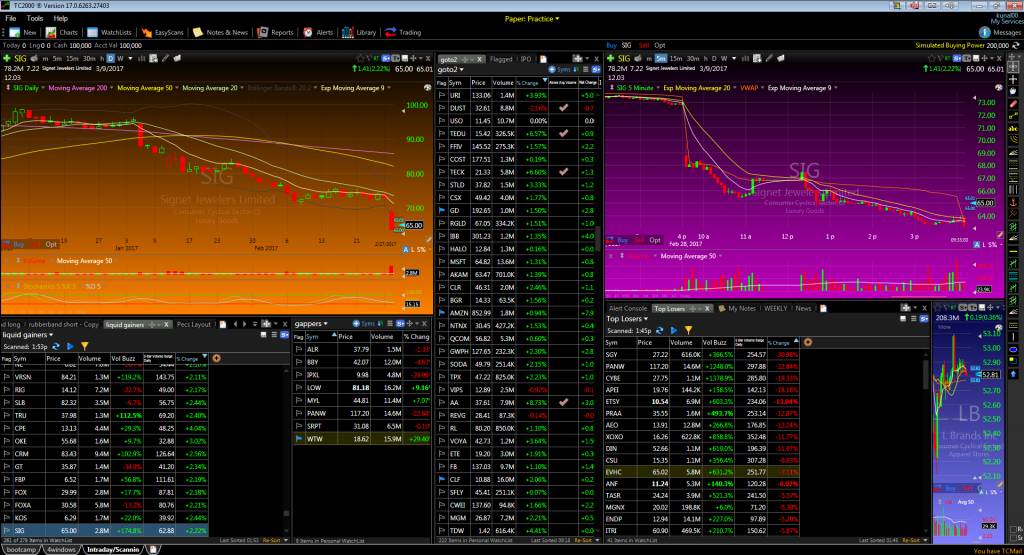

Due to a huge, swift drop in price, $SIG was temporarily halted. Once it started trading again, we treated it like it had just opened in the morning. The first candle was a big green one, but it didn’t last. The next candle was red. When it broke below the low of the previous candle, I opened a partial short position.

The stock dropped a bit more and then it consolidated. This is one of our favorite setups, the ORB – Opening Range Breakout/Breakdown. I waited for $SIG to break below the opening range price, and it didn’t disappoint. As it broke lower, I loaded up the rest of my position. I covered most of the position into the first spike down. It then popped back up into the breakdown spot, but didn’t move above it, so I added to the position again. From there, it drifted lower for the rest of the day and I continued to riding it down, but most of the gain was in the first 20 minutes of action. Total profit – $2100.

This is the sort of thing we trade every day in our chat room. It’s a great place to hangout if you like trading momentum stocks, as you will not only have me watching out for them but all the rest of the room! We offer monthly, quarterly, and annual subscriptions, with a significant discount for the annual plan.

If you really want to learn every aspect of my trading system though, the Bulls Bootcamp is the way to go. It’s an intensive 60 day course to teach you exactly how I trade and why. We are offering special early bird pricing until midnight tonight (March 1st) and payment plans after that. To learn more or signup, email maribeth@bullson.ws today!